What is luxury? Some would refer to it as prestige, desire or exclusivity while some others would refer to it as quality and enjoyment. Many companies and many brands worldwide are aiming to take place at the top of the pyramid and only the most appreciated and well-known ones succeed to remain there. For these brands,

quality is not only a standard for the goods they sell, but also the element of design, exceptional craftmanship, attention to detail, and retail experience and service all throughout each communication channel. The feeling of

exclusivity is provided within the stores and by the number of goods sold per each item; the consumers know that there are only a certain number of people who are carrying that certain handbag, or watch, or jewellery, or any other kind of apparel item.

The total consumer goods luxury market worldwide, which is estimated to be larger than 200 billion EUR, is run by a small number of players which are either mid to large size conglomerates, or companies that are either privately owned or publicly traded.

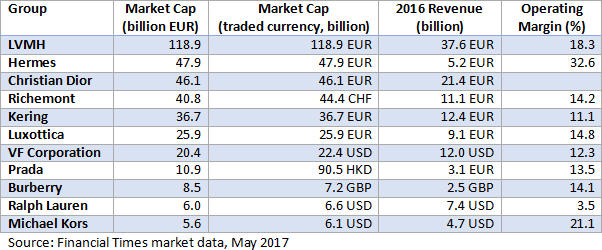

The main publicly traded players in the luxury goods market, their current

market capitalization and revenues for 2016 can be seen in the table below:

Luxury Market – accessories and ready-to-wear

When the luxury market is analysed, it can be observed that the French brands have a longer heritage dating back more than hundred years. The origin of these brands is mostly based on accessories. For example, Cartier’s core business is jewellery, and Louis Vuitton has started the business with “luggage for explorers”. These brands were successful in sustaining their position in the market and growing even stronger in today’s market while enjoying higher margins.

The Italian brands were mostly established after the 1970s and they are mainly focused on ready to wear. The creator and head designer or one of the designer’s family members are still running these companies; some examples are Giorgio Armani, Dolce Gabbana, Versace, etc. The owners and chief creative officers have created these brands and therefore they may be finding it difficult to become a part of a bigger conglomerate and have to abide by their rules.

Each company or group has its own growth strategy: be it through consolidation or staying independent to benefit from flexibility.

Major Conglomerates

The three major luxury conglomerates worldwide are Louis Vuitton Moët Hennessy (LVMH), Kering and Richemont.

LVMH consolidates its businesses in 6 sub-categories. The fashion and leather goods segment holds brands such as Louis Vuitton, Loewe, Berlutti, Loro Piana, Fendi, Céline, Christian Dior, Emilio Pucci, Givenchy, Kenzo, Marc Jacobs and more.

In 2016, the LVMH Group, holding 70 prestigious brands, recorded net revenues of 37.6 billion EUR of which 12.8 billion EUR were generated through fashion and leather segment. The total retail network of the group is over 3,940 worldwide, while the fashion and leather segment has more than 1,500 stores. LVMH Group is one of the best practices in the world of luxury consolidation. The Group has recently acquired Christian Dior for 12.1 billion EUR.

Kering (previously PPR) is active in fashion, leather goods, jewellery and watches and holds renowned brands such as Gucci, Bottega Veneta, Saint Lauren, Alexander McQueen, Balenciaga, Brioni and many others. The group has operations in more than 120 countries and recorded a net revenue of 12.4 billion EUR in 2016 of which 4.4 billion EUR was generated from the Gucci brand alone.

Richemont is another large-scale luxury goods group and is focused on jewellery and watches. Its main brands are Cartier, Van Cleef & Arpels, Piaget, Vacheron Constantin, Jaeger-LeCoultre, IWC Schaffhausen, Panerai and Montblanc. The group recorded a net revenue of 11.1 billion EUR in 2016, 54% of which was generated through its jewellery maisons. Richemont acquired Net-A-Porter, a major online luxury fashion retailer in 2010 and proceeded to merge it with YOOX Group to now hold a 50% share in the merged YOOX Net-A-Porter Group.

Prada Group is another important player in the market with its well-known brands such as Prada, Miu Miu, Church’s, Car Shoe and Marchesi 1824. Prada recorded revenues of 3.1 billion EUR, 81% of which was generated through the Prada brand. It produces men's and women's leather goods, clothing and footwear in addition to eyewear and fragrance.

When we look at the origins of these conglomerates, we can see that at the heart of each group there is one strong core brand. Examples could be Louis Vuitton for LVMH, Gucci for Kering and Cartier for Richemont. This is one of the major reasons these conglomerates have made a jumpstart and secured sustainable growth.

While these major conglomerates are competing in the world of luxury for better margins and double-digit growth figures, there are also other conglomerates which have different targets. For instance, OTB, owned by Renzo Rosso (also the owner of Diesel), is aiming to be the coolest in the market, rather than the biggest. The mission of the company is to build brands for a new breed of consumer – enabling development, challenging rules and fostering creativity. OTB holds brands such as Diesel, Maison Margiela, Marni, Viktor&Rolf, and Staff International which is a state-of-the-art manufacturing company for Marc Jacobs Men, Marni Men, Vivienne Westwood, DSquared2, Just Cavalli, etc.

Benefits of consolidation

The companies in the luxury segment have opted for consolidation as there are noticeable benefits to fuelling growth through mergers when organic growth slows down.

Consolidation provides companies with a number of benefits in terms of increased sales, economies of scale and improved efficiency in the areas of human resources and legal affairs, better understanding of consumer behaviour and expectations, lower marketing and logistic costs, and higher profitability. Sales increase through presence in different geographies and through a diversified product portfolio. The costs are cut down when rental arrangements for retail stores can be negotiated in a larger scale and the marketing efforts are shared between brands. The conglomerates can enjoy the benefits of a talent pool to diversify its workforce and managers. They can also benefit from the increased exposure to customer information for a better and more effective CRM application. All these factors increase the conglomerates’ competitiveness and profitability while mitigating risks.

Consolidation in the sector demands high amounts of capital which can either be funded by company capital, the owners or by inclusion of private equity firms. The luxury industry is attractive to private equity companies as the margins are high and the risks involved in exit strategies are less. The investment of private equities in a globally well-known luxury brand also increases exposure and creates positive publicity for itself worldwide.

Challenges of the luxury market

The luxury industry also faces several challenges. The drop in tourism in the European market, post-Brexit currency devaluation in the UK and the slowdown in the Chinese economy have negatively impacted the sales revenues in the past few years. At the same time, as most of the luxury groups operate in Euros, British Pounds and Swiss Francs but generate revenues from the rest of the world mainly in US dollars, the currency fluctuations have big impact depending on the currency movement.

It should also be noted that the luxury segment is a high fixed cost industry when the flagship stores, long term artisans and workforce, and the long-term retail commitments and advertisements are considered. This limits flexibility in terms of swift response to changing economic environments. The major luxury brands need to have the first-mover’s advantage to maximise sales when the market is ready to purchase luxury goods. Only in this way the consumers aspire to purchase from these brands and become loyal customers in the long run. This means a financial burden as the flagship store’s return on investment may take more than three years.

Future of the luxury industry

The future of the luxury industry will depend on factors such as choosing the right geographies and locations, understanding changing consumer and purchasing trends and digitalization.

The changing economic environment in the global world demands the companies to adapt their presence and investments. The millennials have different values and prioritize sustainability, originality in terms of design and authenticity when purchasing luxury items. The digitalization may probably be the most important factor for luxury segment as traditional comfort zones of slow movement need to become faster. The customers growingly demand a digital presence and online shopping experience from the luxury segment.

The share of luxury products in the online shopping volume is expected to grow faster than traditional retail and double in the next 5 years. The customers demand a swift opportunity to shop from the collection right after it is launched through a catwalk and investments in technology to provide this opportunity is becoming essential. Therefore, as consolidation in the sector increases it is expected that some tech companies may also join in the groups’ portfolios to provide this infrastructure.

~ ~ ~ ~ ~

Back to top

THE FUTURE OF THE TEXTILE AND CLOTHING INDUSTRY IN AFRICA

When the World Trade Organization ended the textile and clothing quota system in 2005, large textile and clothing producers such as China and India were amongst the key beneficiaries, while Africa was among the big losers. As part of the Chinese and Indian supply chain, other South East Asian countries like Bangladesh, Cambodia, Sri Lanka and more recently Vietnam benefitted from this transition. Before 2005, many of the investors in the African textile and clothing industries came from the Middle East, India, Pakistan, Sri Lanka and Taiwan. Ever since they returned to Asia.

The effect of the quota system on the African textile industry is clear from the trade figures: imports into the USA from Sub-Saharan countries dropped from 1.8 billion US$. in 2004 to just over 1 billion in 2016. 2017 does not show any further improvements.

In Nigeria, for example, between 1985 and 1991, the textile and clothing industries recorded an annual growth of 67%, and as at 1991, it employed about 25% of the workers in the manufacturing sector. In Mauritius, the textile and clothing industry experienced a rapid growth in the 1980s up to the year 2000 when it employed over 80,000 people, or over 70% of the total manufacturing industries. Other African countries were experiencing similar trends. In addition, the USA implemented the AGOA African Growth and Opportunity Act in 2000. Many sub-Saharan countries were eligible for special conditions to export a wide range of goods and products to the United States under the AGOA Act. Countries like Lesotho benefitted from this and set up an important clothing industry.

However, with the abolition of quota in 2005, Sub-Saharan countries were not really able to improve the performance and development of their textile industries. Many jobs were lost and textile companies closed after 2005. Now also eligibility of African countries for AGOA is under continuous pressure.

Politics can be seen as having a very high impact on the global development of the textile & clothing industries. Globalisation and government policies (investment and trade) in China and India have resulted in a boom of the Asian textile industry. At the same time it affected negatively the Sub-Saharan textile industry.

The development of the textile & clothing industries in Turkey can equally be seen as a result of government policies: free access to the European market and strong government support still make Turkey one of the stronger textile producing countries at present.

Regional trade agreements implemented by governments and driven by political ideologies can indeed influence heavily the industrial development of countries and the prospects of generations of people. When looking at how Europe’s imports have evolved since 2000, one can see again the enormous impact of the abolition of quota. While in 2004 imports from China into the EU of textiles and clothing reached just over 16 billion €, for Egypt/Morocco/Tunisia combined this was just over 6 billion €. Since then imports from China have reached over 40 billion € while North African imports stagnated. Could the present European migration crisis have been prevented if North Africa would have received a fair share of the trade growth into Europe?

The European Union is in the process of negotiating and signing seven “Economic Partnership Agreements” (EPAs) with regional groups in Africa, the Caribbean and the Pacific. Economic evidence of who is to benefit from it is mixed and although there will be trade gains on both sides, it is European exporters that would be the biggest winners. Africa’s agricultural industry could benefit but the manufacturing industry would come under greater pressure.

What is then the future of the textile & clothing industries in Africa? While labour costs are competitive in a wide range of African countries compared to Asia, especially with costs in China growing rapidly, they lack training, both at middle management and operator level, they cannot benefit from economies of scale like China or India and corruption is still important. The African textile & clothing industry failed to industrialise on a large scale although in theory the conditions were good. There are good examples of industrialization, even if on a lower scale then in Asia. Further industrialization of the African textile & clothing industries to satisfy growing global consumption of clothing, home and technical textiles can happen in Africa. But it will require an important, consistent and long lasting political commitment and the vision to implement the right policies. If the textile & clothing industries in Africa are to flourish, it requires political will in both North and South.

~ ~ ~ ~ ~

Back to top

Management consultants to the world textile, apparel & fashion industry

Werner International is a management consulting practice specialized exclusively in the fiber, textile and fashion industry

globally active since 1939.

Werner’s services range from industrial and technology support

for setting-up, improving and restructuring

textile and clothing manufacturing operations

to strategy and marketing services for new market entry,

new product development, supply chain management,

branding, retailing, partner search

and future strategies build-up.

Werner is unique among world leading consulting companies

in being able to combine specialized expertise

in the technical areas with global marketing and

strategy know-how and supply chain integration.

Werner International, Inc.

13800 Coppermine Road

1st, 2nd, 3rd Floors

Herndon, VA 20171 USA

Phone + 1 703 871 3938

Fax + 1 703 871 3901

www.wernerinternational.com

info@wernertex.com

Copyright © 2017